- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Retirement Specialist

Scott Kliewer | NAIC

Protect what matters most

You can't predict the future, but you can plan for it

We're here to help you learn more about the different types of life insurance and how they can benefit you and your family.

Fill out the form and our team will get in touch!

Life insurance doesn't have to be complicated

Fill out our quick survey below and see how we can help you!

We respect your privacy

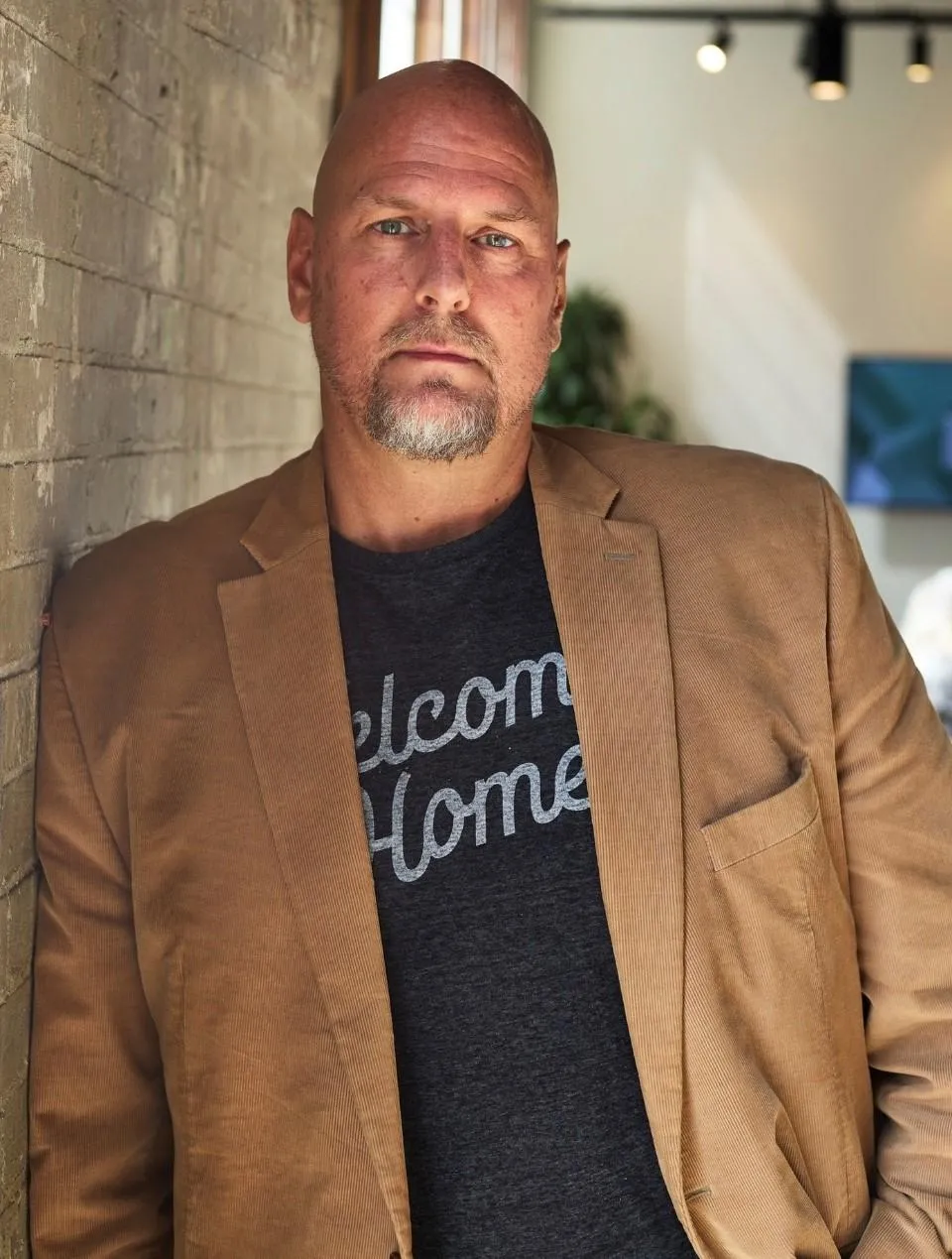

Scott Kliewer

Founder/CEO

Retirement Specialist

Educated-Wealth

15+

Of the Industry's best providers

"Life insurance can be complicated, but it doesn't have to be! As a licensed Broker, I can help you navigate your insurance options with ease."

National Producer #: 17885953

Scott Kliewer

Scott Kliewer is the founder and CEO of Educated-Wealth. After 15 years in public education through teaching and eventually running schools in New York and California.

Scott realized the enormous financial gap created in our society because of the lack of education on money and finances. “Everyday we need and use Money, so why don’t we teach on it?” He left the education field and became the change he wanted to create.

Since 2016, Scott and his team have met with over a 1000 families, business owners, and real estate investors, to build tax free retirements, protect liquid assets, and have as a result created 100s of millions in generational wealth.

Everyone's needs are different

That's why we're here to help you understand how life insurance can work for you.

It can be used to pay off mortgages, provide a source of income, cover final expenses, and more. It's also relatively inexpensive, especially when purchased at a young age, making it a financially sound investment for your family's future.

Did you know, life insurance can also be used as a way to save for your retirement? Some types of life insurance policies, such as whole life insurance, have a savings component that can accumulate cash value over time. This cash value can be used as a source of income during retirement, as well as a way to pay for long-term care expenses. You can also borrow against it for other purposes such as education funding for children, starting a business, or paying off debts.

OUR SERVICES

WE HAVE YOU COVERED

Infinite Banking

Infinite banking is a personal finance strategy that leverages a whole life insurance policy as a personal bank.4 It allows policyholders to build value in a policy that can then be loaned against without having to go to banks or lenders.

Indexed Universal Life

IUL policies offer a unique combination of flexibility, potential for cash value growth, tax-advantaged savings, and a guaranteed death benefit, making them a valuable option for those looking for a permanent life insurance policy

Term / Whole Life

Two of the most common types of life insurance are term and whole life. Whole life is a form of permanent life insurance that lasts as long as you live (assuming you pay the policy’s premiums). It also includes a cash value account—a type of savings account that grows tax free over time and that you can withdraw from or borrow against while you are alive. Term life insurance, on the other hand, lasts only for a certain number of years (the term) and does not accrue any cash value.

Indexed Annuities

A fixed indexed annuity (FIA) is a type of annuity contract that provides a guaranteed income stream, while also offering the potential for growth tied to a stock market index, such as the S&P 500.

INDUSTRY'S TOP CARRIERS

Request A Quote

Just fill out the form with your contact information and tell us what you're looking for. We will get back to you as soon as possible.

Life insurance doesn't have to be complicated

Fill out our quick survey below and see how we can help you!

We respect your privacy

Office: City, State

Call +1 240-475-5919

Email: scottkliewer@educated-wealth.com

Site: yourwebsite.com

Copyright © 2023. Yourwebsite.com All Rights Reserved